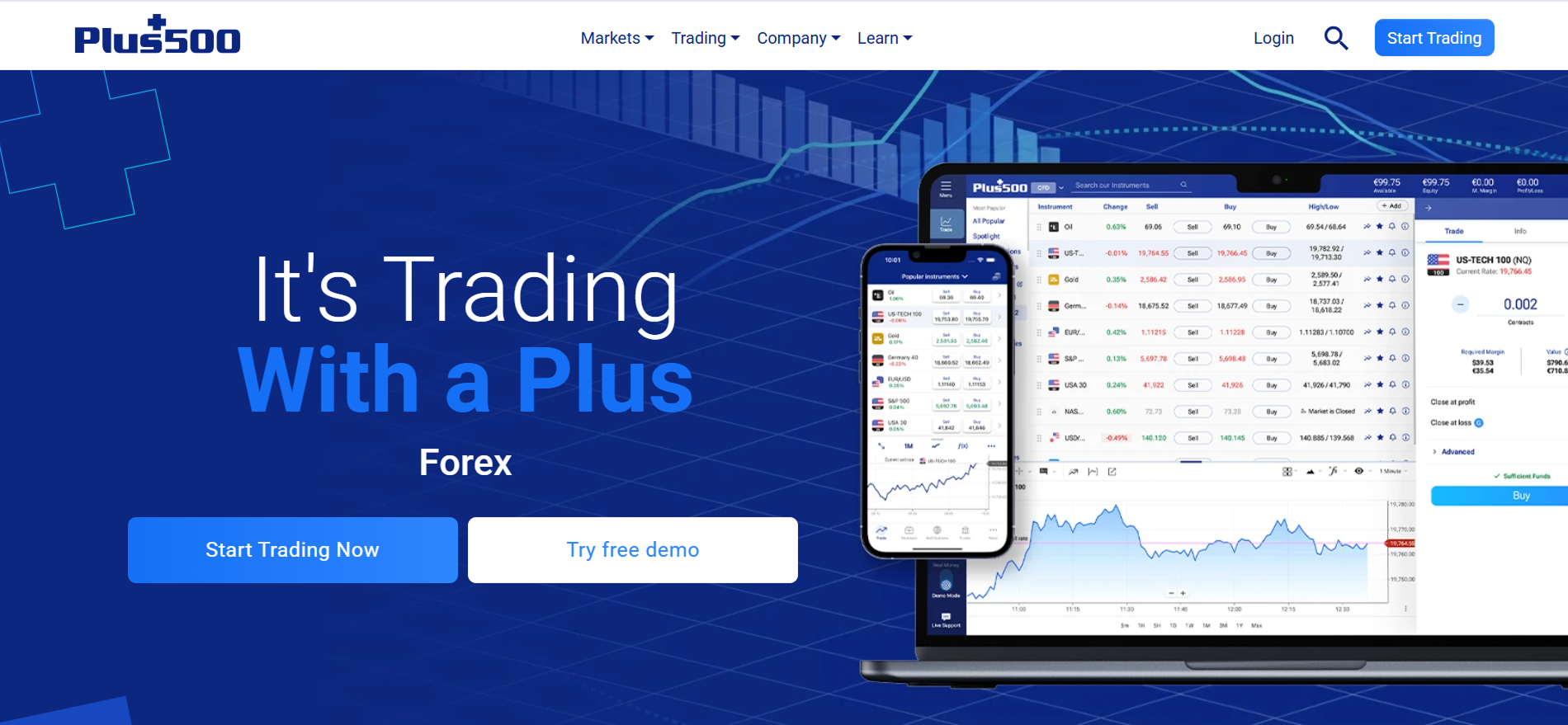

Plus500 is an online trading platform that offers 2,800 Contracts for Difference (CFDs) on cryptos, indices, forex, commodities, shares, and ETFs. It was founded in 2008 and is headquartered in Israel, with additional offices in the UK, Cyprus, Australia, and Singapore. Plus500 is authorized and regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, and the Australian Securities and Investments Commission (ASIC) in Australia. The platform is available in more than 50 countries and supports over 30 languages.

| Founded | 2008 |

| Headquarters | Israel |

| Regulation | ASIC, FSA, CYSEC, FCA, FMA, CIRO, MAS, SCA, DFSA, ISA |

| Market Instruments | 2,800 CFDs, cryptos, indices, forex, commodities, shares, ETFs |

| Demo Account | ✅ |

| Leverage | 1:30 (retail)/1:300 (professional:the professional accounts do not have ICF rights) |

| EUR/USD Spread | Floating around 0.5 pips |

| Trading Platforms | Own proprietary trading platform (desktop, web, and mobile) |

| Min Deposit | $/€/£100 |

| Payment Methods | Visa, MasterCard, PayPal, Skrill, Apple Pay, Google Pay |

| Deposit & Withdrawal Fee | ❌ |

| Inactivity Fee | Up to USD 10 per month charged if not log in to your trading account for 3 months |

| Customer Support | 24/7 |

How are you protected?

Plus500 takes several measures to ensure the safety and protection of its clients, and the fact that it is a regulated broker provides additional reassurance to clients.

Market Instruments

Plus500 offers 2,800 CFDs, including 65 Forex CFDs, 1,623 Stocks CFDs covering equities from global markets, 34 Indices CFDs on major indices like the S&P 500, Nasdaq, and FTSE 100, 23 Commodities CFDs on precious metals, energies, and agricultural products, as well as Cryptocurrencies CFDs on popular digital assets such as Bitcoin, Ethereum, and Litecoin.

Leverage

Plus500 offers leverage for different financial instruments. The maximum leverage offered depends on the instrument and the jurisdiction where the trader is located. In general, the leverage for forex trading can be up to 1:30 for retail clients in the European Union, and up to 1:300 for professional clients.

For other instruments, such as stocks, commodities, and cryptocurrencies, the leverage can vary between 1:5 and 1:30 for retail clients, and up to 1:300 for professional clients.

It’s important to note that higher leverage can amplify both profits and losses, and traders should use it with caution and proper risk management.

Spreads & Commissions

Plus500 offers floating spreads on all trading instruments, meaning the spreads can fluctuate based on market conditions. The spreads for major currency pairs like EUR/USD is to 0.00016. Plus500 does not charge any commission on trades, and their revenue comes solely from the spreads offered.

Trading Platforms

The Plus500 trading platform is an in-house developed web-based platform that can be accessed directly from the Plus500 website. The platform is user-friendly and intuitive, making it easy for traders to navigate and trade various financial instruments. It is also available in several languages.

The Plus500 trading platform offers several advanced features, including price alerts, real-time charts, and technical analysis tools. The platform also includes a demo account that traders can use to practice trading without risking any real money.

Deposits & Withdrawals

Plus500 accepts payments via Visa, MasterCard, PayPal, Skrill, Apple Pay, and Google Pay.

Conclusion

Overall, Plus500 is a reputable and reliable online broker that offers a user-friendly trading platform, competitive spreads, and a wide range of trading instruments. It has a strong regulatory framework and offers various measures to protect its clients. Plus500 also provides excellent customer service with 24/7 support.

However, Plus500 does have some drawbacks, such as no popular MT4/5, limited contact channels and relatively high inactivity fees.

In summary, Plus500 is an excellent option for beginner traders who are looking for a straightforward and easy-to-use trading platform with a low minimum deposit requirement. It is also a good choice for experienced traders who prioritize a strong regulatory framework and reliable customer service over advanced trading features.